I will explain how to aggregate and monitor LTV and CAC with Shopify to improve profitability.

LTV and CAC may be unfamiliar words, but if you don’t look at LTV, you underestimate long-term measures and miss growth opportunities. If you don’t know the CAC, you will underrate the cost.

I will describe how to monitor KPI trees created from LTV and CAC. Take appropriate strategy, and grow your commerce business.

Contents

What are LTV and CAC Anyway?

LTV is an abbreviation for the Lifetime Value (aka CLV-Customer Lifetime Value). It defines the total profit that one customer spends in his/her lifetime.

CAC, on the other hand, stands for Customer Acquisition Cost. It means the cost required to have one customer purchase a product/service.

CPA is the short term of Cost Per Acquisition, often confused with CAC. If you are a web advertising operator, you may be familiar with it. CPA is an advertising cost for one customer to purchase.

CAC is a customer acquisition cost that includes not only advertising costs like CPA. It has operating costs such as labor costs, consulting fees, and production and operation costs required for organic search strategies such as SEO (Search Engine Optimization) and UGC (User Generated Contents). Don’t forget to calculate the cost of attracting customers organically.

You can’t continue a business unless LTV is greater than CAC

Whether LTV is greater than CAC is a vital issue for business.

If LTV is greater than CAC, the more new customers you have, the more revenue you will earn. On the other hand, if LTV is less than CAC, the more new customers, the lower the payment.

Understanding the relationship between LTV and CAC is also crucial in making investment decisions.

For example, if the gross profit from one purchase is 3,000JPY and the CAC is 5,000 JPY. You may think that you won’t make a profit, but if the average purchase frequency is five times, the LTV is 15,000 JPY (3,000 JPY times 5), which shows that LTV is three times greater than CAC.

Deciding with just a one-time purchase, you will make a wrong investment decision. It is fundamental to grasp on LTV and compare it with CAC when you make investment decisions.

Generally, the LTV:CAC ratio higher than three is ideal.

Let’s work on the goal of LTV:CAC ratio is three times larger or even higher!

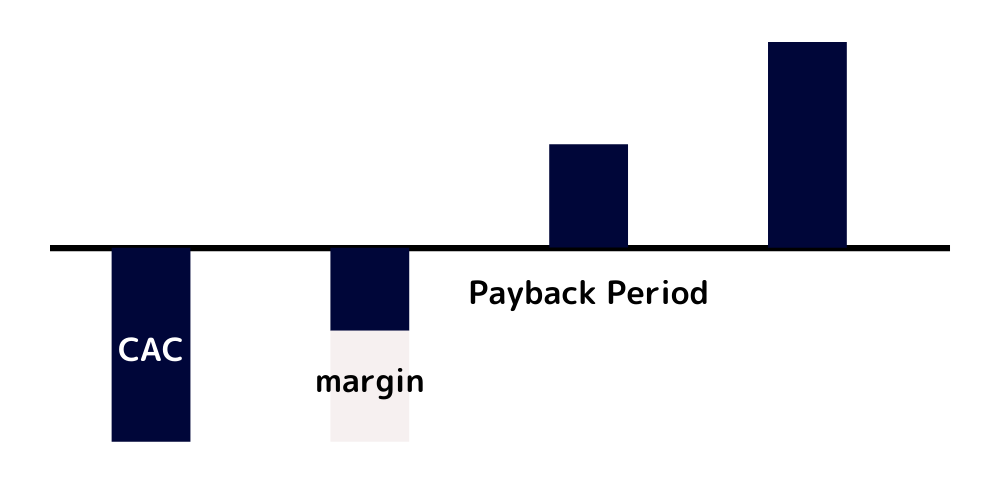

Payback Period (Investment Payback Period)

When considering LTV and CAC, the Payback Period is also essential. The Payback Period is the time in which the investment cost can make recoveries.

Even LTV is greater than CAC; you won’t wait if you are aiming to recover it for ten years. In the case of large capital, such as an example of the barcode payment service, there may be a business with a Payback Period of more than ten years.

Based on your company’s cash status, you can shorten the Payback period by considering how many months you can wait for collection and manage LTV and CAC.

Generally, a Payback Period of 6 to 12 months is considered as healthy.

KPIs other than LTV and CAC

There are essential KPIs (Key Performance Indicators) in the commerce business other than LTV and CAC.

Any commerce company should understand LTV and CAC are for understanding individual customer profitability. There are other KPIs related to inventory and manufacturing management.

Determine and focus on which KPIs your business requires and perform fixed-point monitoring in detail.

Shopify has a list of KPIs that you can use in your commerce business. As expected, our awesome Shopify (LOL)

If you prefer monitoring data other than Shopify, I recommend making the dashboard in Google Data Portal.

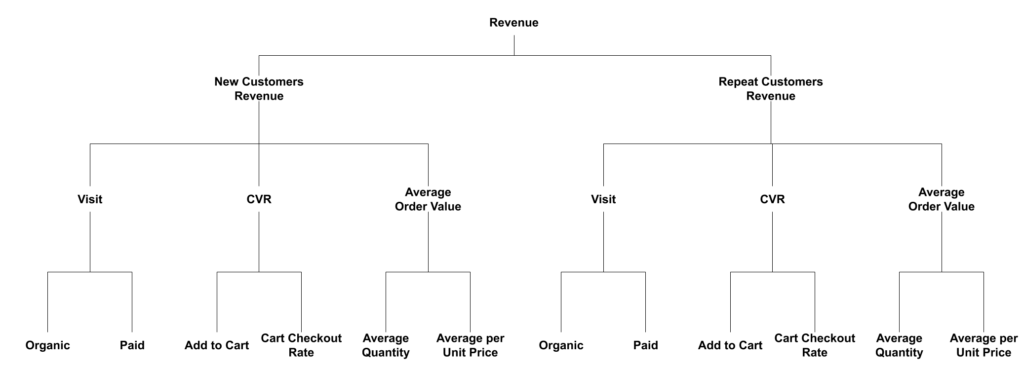

KPI Tree

It is convenient to utilize the KPI tree when deciding your own KPI.

KPI tree is a way to manage final goals (KGIs-Key Goal Indicators). Stitch KPIs together to create and monitor KPI trees.

The following is an example of a KPI tree when KGI is Profit.

KPI trees vary from each company. Set a KPI that will be a shooter.

LTV and CAC Calculation Method

This section explains how to calculate the LTV and the CAC of Shopify.

LTV calculation method

LTV calculation formula is as follows.

LTV = Gross profit per one order x Lifetime orders per a customer

Calculating “the number of gross profits per one order” and “the number of lifetime orders per a customer” is required in advance to calculate LTV. It listed below;

Gross profit per order = Total gross profit / Number of orders

Lifetime orders per a customer = Number of orders / Number of customers

It isn’t easy to calculate the purchase frequency. Even if it is called the Customer “Lifetime” Value, it can’t be estimated over an infinite time. The purchase frequency is often determined by how many times a customer purchases in two to three years.

There’s no way to know the exact purchase frequency if you’ve just launched a store. In that case, the LTV is calculated by temporarily placing the purchase frequency regarding data such as the industry average.

LTV Calculation method in Shopify

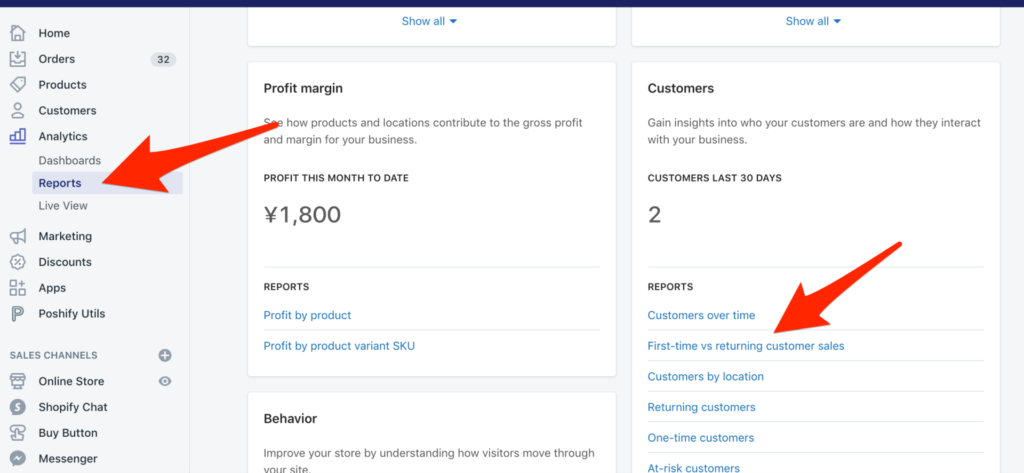

There are several ways to calculate LTV from the Shopify data.

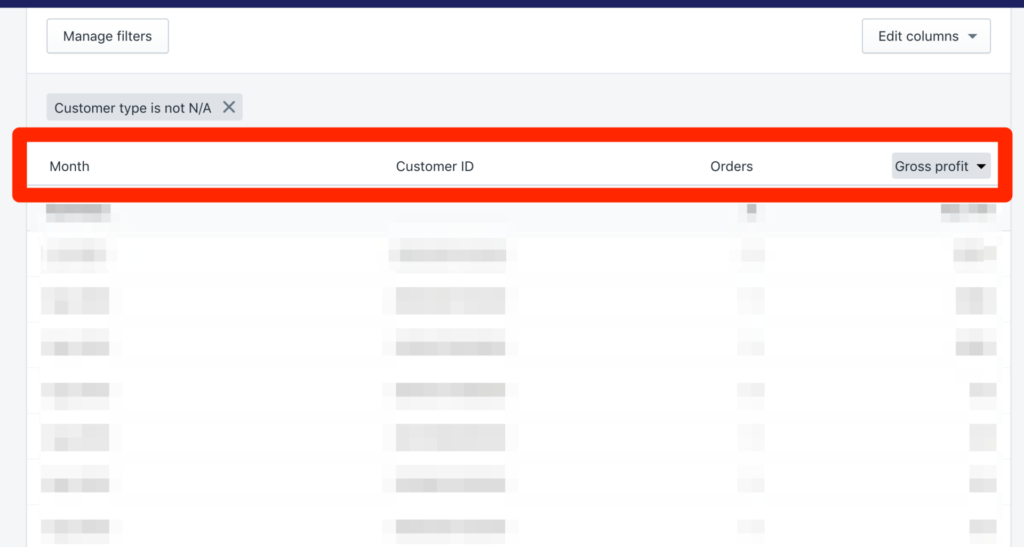

I prefer creating a custom report for LTV calculation. Go to “Analytics” in the Shopify Store > “Report”> “Customers”> “First-time vs. returning customer sales.”

Set to display Month, Customer ID, Orders, and Gross profit in the report. Save as a report for LTV calculation.

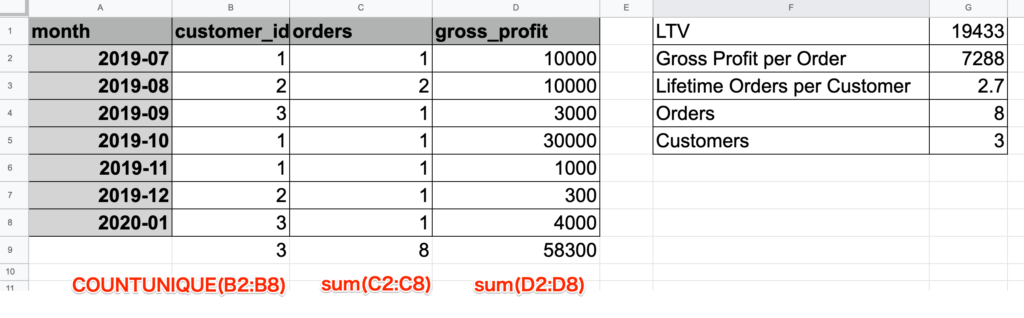

Export the past two to three years of this report and aggregate each item for LTV calculation.

- The number of customers is the sum of “customer_id” with the COUNTUNIQUE function.

- The number of orders is the sum of “orders” with the SUM function.

- Gross profit is the sum of “gross_profit” with the SUM function.

You can calculate LTV by applying a value to the formula below.

LTV = Gross profit per one order x Lifetime orders per a customer

Gross profit per order = Total gross profit / Number of orders

Lifetime orders per a customer = Number of orders / Number of customers

With the premium Shopify app Lifetimely, you can put out LTV. You also can monitor various KPIs in addition to LTV. Please try this app if you want to perform KPI monitoring firmly.

CAC calculation method

The CAC calculation formula is as follows.

CAC = All costs for acquiring new customers / Number of new customers acquired

The CAC includes not only advertising costs, but also all charges used for acquiring new customers such as content creation, exhibition fee, consulting fee, labor cost, etc.

In advertising, you can break down CAC by channels such as Google Ads, Facebook Ads, Instagram Ads, etc., and consider whether to invest or reduce the budget.

Payback Period Calculation Method

The calculation of the Payback Period is as follows.

Increase gross profit and reduce CAC lead the Payback Period will be within 6-12 months.

Improving LTV and CAC

Let me introduce the concept of improving LTV and CAC.

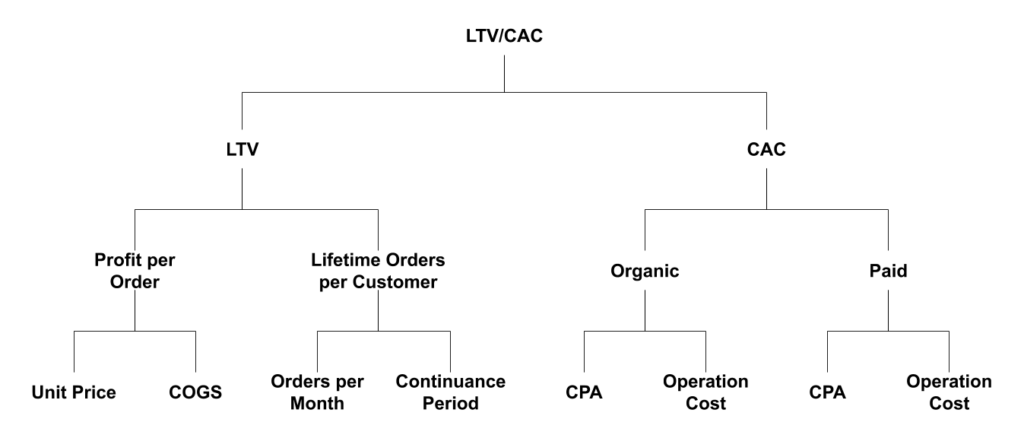

The KPI tree of LTV/CAC is as follows.

From the above KPI tree, to increase LTV should be the following.

- Raise the unit price.

- Lower costs.

- Increase the number of orders per month.

- Increase and extend the number of months of use.

To lower CAC, do the following:

- Lower CPA (Increase CVR-Conversion Rate & Lower CPC-Cost per Click).

- Reduce operating costs.

Implement these strategies while paying attention to the following three points.

- Aim for scale-up after raising LTV.

- Find a growth driver.

- Consider not only the positive but the negative side of the plan.

Aiming for Scale-Up after increasing LTV

The targeted advertisements for high-value audiences will keep lowering CAC. Such as affiliates, keyword-linked, and remarketing advertisements. But aimed at a wider audience, it tends to get worse when using network advertisements and authentic advertising methods.

However, to expand the commerce business, you also need mass-targeted advertising.

Therefore, it is significant to increase the LTV in the early stages so that profits will stabileze even if you approach mass and the scale-up.

Find a growth driver

You can come up with an infinite number of ideas to improve LTV and CAC. It is exhausting to keep striving without clear intentions.

Ascertain high-performing customers, products, and advertising channels based on analyzing data can reduce wasting your efforts.

Let’s find out why the customers are buying so much and the products being sold so much.

Considering not only the positive but the negative side of the measure

Another point to note when improving LTV and CAC is that a strategy to raise one KPI may worsen another KPI.

For example, raising the unit price can reduce the number of purchases and worsen CPA. You should better pay attention to balanced consideration whether the plans are improving or getting worse.

Examples of improving LTV

Here are some typical examples of improving the LTV.

<Raise in unit price>

- Raise a price.

- Sell high-spec products.

- Provide optional services.

- Cross-Selling.

- Sale of bundled products.

- Standardize Free shipping.

<Reduce costs>

- Increase the number of manufactures and purchase top-selling products.

- Improvement of manufacturing cost.

- A decrease in logistics costs.

<Increases the number of orders per month>

- CRM (Customer Relationship Management) in general.

- Upsell immediately after purchase.

- Increase the number of products.

<Increase & extend the number of months of use>

- Anniversary setting.

- Seasonal Offer.

- Reactivate dormant customers.

- Personalized product.

- Enhance customer support.

- Email newsletter.

- Loyalty program.

Examples of Improving CAC

Here is also a list of typical examples of improving the CAC.

<Increase the CVR>

- UI improvements.

- Rich product information.

- Collect reviews.

- Add more payment services.

- Budget for high CVR ads.

<Lower the CPC>

- Budget for low CPC ads.

- Increase your quality score.

- Make lower bids.

<Reduce operating costs>

- Streamline and automate operations.

- Reuse contents and creatives.

Integrating the Shopify App can compensate for system-related measures for both LTV and CAC.

Summary

I’ve introduced how to aggregate and improve LTV and CAC in Shopify. It seems that many stores do not verify the accuracy of the LTV and CAC even though they monitor sales, gross profit, CPA, etc.

If you ignore the LTV, you will underestimate long-term CRM, which results in missed out on growth opportunities.

Please monitor the KPI tree created from LTV and CAC, and build appropriate strategies to grow your commerce business.

What do you usually monitor? Please let us know in the comments!

GrowthHack consulting services specialize in Shopify

StoreHero provides the Commerce Hack and a growth hack consulting service specialized in Shopify.

It supports Shopify owners to grow faster, get their businesses back on track, and run their businesses.

If you want to use Shopify to grow your commerce business, please do not hesitate to contact us.